Agilent Technologies is a life sciences company that provide a range of analytical instruments involved primarily in quality control and assurance of the lab. Its expertise largely sits in the highly specialised field of liquid/gas chromatography and mass spectrometry instruments. This underpins the company's comprehensive and growing services, consumables, and informatics piece. Its presence in the industry spans several decades, with an installed base touching over 265,000 labs around the globe across a diverse set of end markets including pharma, food testing, chemicals, academic and government, as well as environmental.

Waters Corporation are Agilent’s prime competitor in the core analytical instruments space, with each company commanding as much as one-third across the liquid/gas chromatography market. While both company’s core instrument businesses are deeply embedded in their customers’ labs, the growth profile of this mature side of the market has stabilised at low to mid-single digits, whereas areas such as biopharma, cell analysis, and diagnostics have taken the front seat and are seeing roughly 80 per cent of total R&D investment in the market, resulting in high-single digit to low-double digit growth each year. With that in mind, we saw two very different approaches to capital management, which has consequently seen a seismic shift in market position and product offering. However, we must jump back to 2015 to appraise the significance of the two capital allocation pathways for each company.

The state of play

In March of 2015, Mike McMullen was appointed CEO of Agilent Technologies, an internal hire very well-respected in the company. It was then that the wheels started to turn as the initial steps of the transformation commenced. McMullen introduced the One Agilent initiative, a cultural transformation across the organisation that looked to optimise the company’s capabilities for customers. This helped underpin another new initiative in Agile Agilent, a multi-year cost reduction program aimed at closing the profitability gap to key peers in the industry. The third major piece of the puzzle that has proved critical to the transformational process, their Build and Buy strategy, focuses on both organic and inorganic activity to pivot the company’s portfolio towards those aforementioned higher growth areas of the market. This collaborative organisational effort to focus on a renewed R&D program and a carefully curated bolt-on strategy enabled Agilent to build out a solid presence in biopharma, cell analysis, and diagnostics, all of which have been moving forward with continued strength. Furthermore, there was a real push from McMullen to drive investment on their services and consumables business (Agilent’s CrossLab division), which has enabled the company to maintain annual high-single-digit growth of attractive recurring revenue.

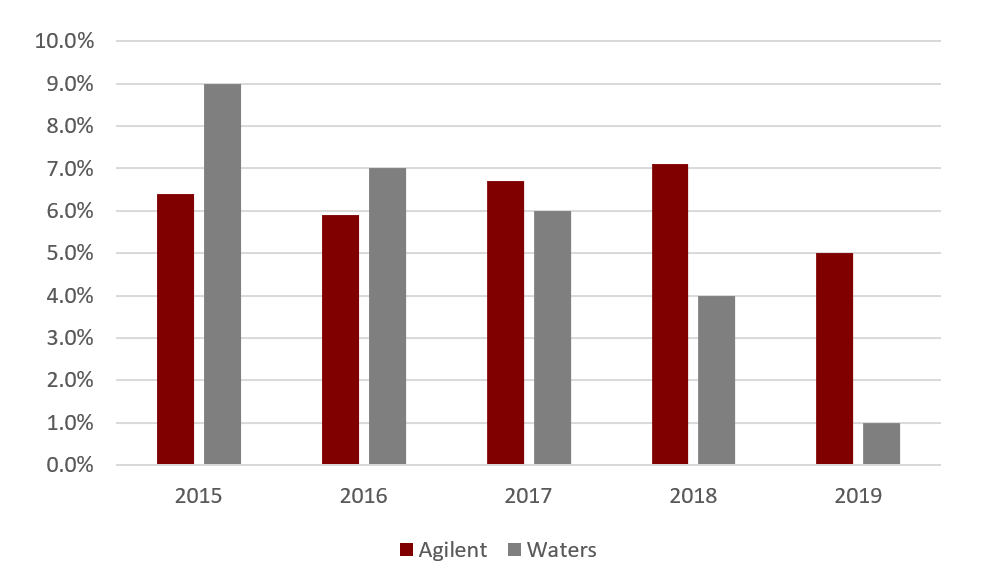

On the other side of the coin, Waters management decided on a share repurchase strategy, allocating close to 100 per cent of capital to buybacks over the same period (close to US$4.5bn). What we saw was a consistent yearly decline in organic growth, falling as their traditional market came under pressure for a variety of reasons, and subsequently conceding share to key peers in the industry. We saw little acknowledgement of the need to use capital to penetrate new areas of the market, with management adamant on utilising their cash reserves solely to repurchase stock (which we do not believe is the most effective medium in generating long-lasting shareholder value). Agilent’s ability to pivot the business to more attractive and resilient areas of the market allowed the company to maintain a consistent, reliable growth profile, grabbing market share and highlighting the relative successes of the two strategies (see chart below).

Organic Growth Comparison (%)

A decisively cautious approach

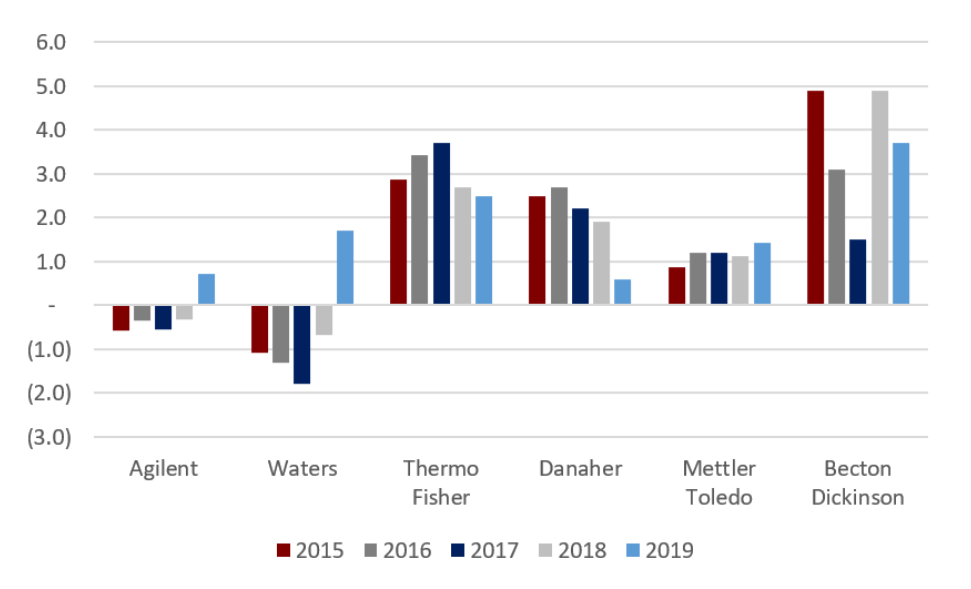

While we stand impressed with the way Agilent’s management team have transformed the business, we are even more impressed in its management of capital structure. The company has always been conservatively financed and is a prudent manager of the balance sheet, which can sometimes make it difficult to compete with the traditional big spenders in the industry. However, looking across at key peers, there are many companies that have taken a relatively aggressive approach to M&A, but at the same time are content riding up the balance sheet to what we view as uncomfortable levels (over 2.5x net-debt-to-EBITDA over an extended period of time). Agilent, as can be seen in the chart below, has been able to pivot the business without leveraging up the balance sheet to those uncomfortable levels. It is this decisive yet cautious approach that gives us confidence in the team set in the role of sensibly allocating capital for the company.

Net-debt-to-EBITDA Comparison (x)

Culture

Finally, the glue that holds all of this together for Agilent is undoubtedly the culture that McMullen has brought to the company through his tenure at the helm. The integration between R&D teams, the sales force, service technicians and every other area of the organisation has enabled the execution of the strategy and the gradual transformation to the business we see today. A prominent example of this strong cultural undertone can be found as the COVID-19 pandemic struck back in March 2020. Instead of opting to furlough employees, reduce work hours, and instigate salary reductions (as was the case with Waters), employees at Agilent were told not to worry for their job, with no furloughs or pay cuts to base salary that could ultimately have disrupted the engine that has been so critical in building momentum for the company over the last five years.

Our take

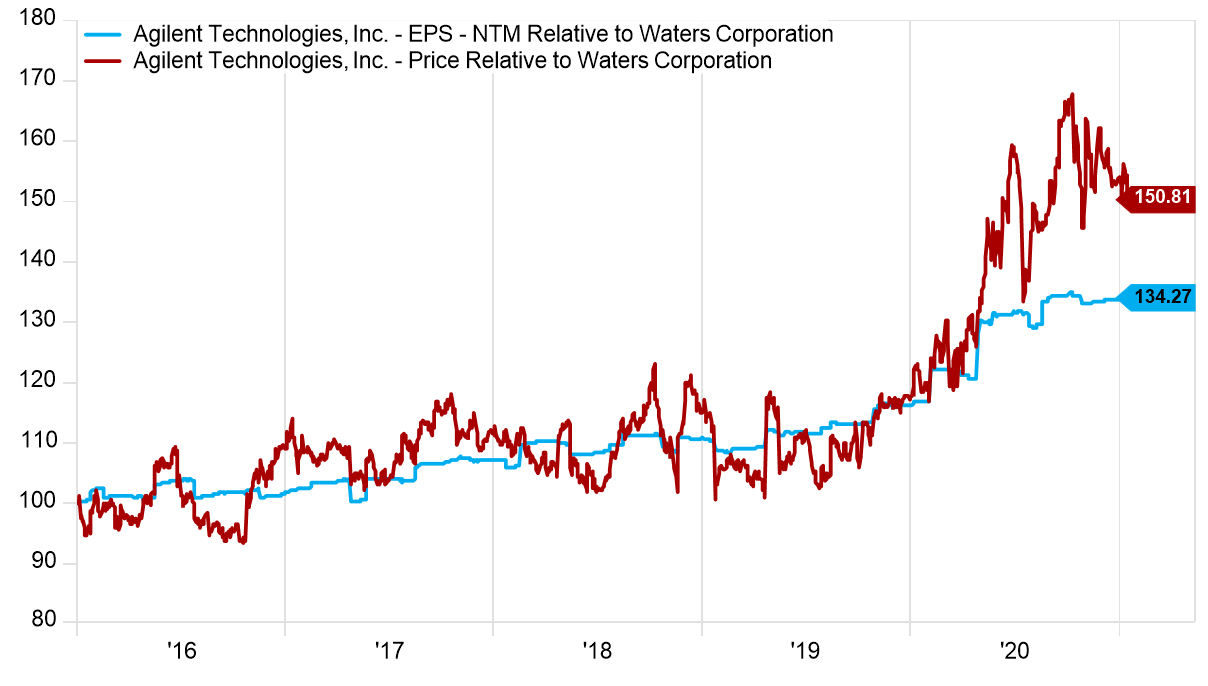

What we can yield from this comparison of two of the world’s leading analytical instrument players is that poor capital allocation decision-making can stifle even the most embedded players in an industry. In our opinion, the key decisions made by Agilent’s management team back in 2015 have enabled the company to deliver over 6 per cent organic growth p.a., approximately 450 basis points of margin improvement, and close to 14 per cent earnings growth each year. In the chart below we can see the relative earnings and share price performance over the last five years, with Agilent’s earnings outperforming by over 34 per cent driving a ~51 per cent outperformance on the share price. We note the ‘healthier’ earnings profile of Agilent and draw you back to Waters’ reliance on enormous share repurchases to generate earnings growth over the period (i.e. the ‘real’ earnings delta is much higher).

Earnings and Price Relatives

A key foundational pillar to our investment process unsurprisingly focuses in on a company’s management team and their ability to allocate capital in an astute and effective manner. Whether this be in the form of organic research and development, inorganic pursuits in the market, dividends or share repurchases, the balance management decides to strike can have a considerable impact on the medium and longer-term performance of the company relative to its peers.

Waters has just brought in a new CEO and is conducting a comprehensive review of every part of its business in a bid to pull the organisation back on the track. Most recently at Agilent’s investor day in December of last year, the company raised three to five-year guidance on the top-line, increased margin leverage expectations, and can expect to deliver continued double-digit earnings growth over the same period. This increased confidence from management only bolsters our investment thesis and provide us the strong level of comfort we need as one of only a handful of quality companies within our concentrated portfolio. This first-hand example highlights the importance of not standing still, making good capital allocation decisions early in the piece that can ultimately set a company up for long-term success.